金融风险管理师试题(七)

2016-08-18 11:03 互联网 责编:admin

2024年FRM备考资料

- FRM考纲变化

- FRM英语词汇及公式表

- 思维导图

- 全新复习资料

- 前导课程

- 历年习题汇总

31.You are given the following specification of the currency swap:

notional principal$10m euro 10.5m

swap coupon 7.2%6.8%

current market yield 4.2%3.6%

There are two payments left in the swap(the first one in a year)and the current exchange rate is$0.95/euro.Calculate the dollar value of the swap for the euro payer.

A.-$16,299.

B.-$17,344.

C.-$19,344.

D.-$21,283.

Correct answer:A

The swap is equivalent to long position in dollar denominated bond and short position in euro denominated bond.(720,000/1.042+10,720,000/1.042^2)-((714,000/1.036+11,214,000/1.036^2)x0.95)=-16,299.

32.How would you describe the typical price behavior of a low premium mortgage pass-through security?

A.It is similar to a U.S.Treasury bond

B.It is similar to a plain vanilla corporate bond

C.When interest rates fall,its price increase would exceed that of a comparable duration U.S.Treasury.

D.When interest rates fall,its price increase would lag that of a comparable duration U.S.Treasury.

Answer:C

Mortgage pass-through securities,unlike Treasuries or plain vanilla corporate bonds,have an embedded option allowing borrowers to repay the loan at any time.When rates fail,the effective duration of these securities decreases because borrowers will refinance mortgages at lower rates(putting the loans back to the investors);but when interest rates increase,borrowers will hold on to mortgages longer than they otherwise would,resulting in an increase in the effective duration of the loans.This is reflected in the price/yield relationship as negative convexity.

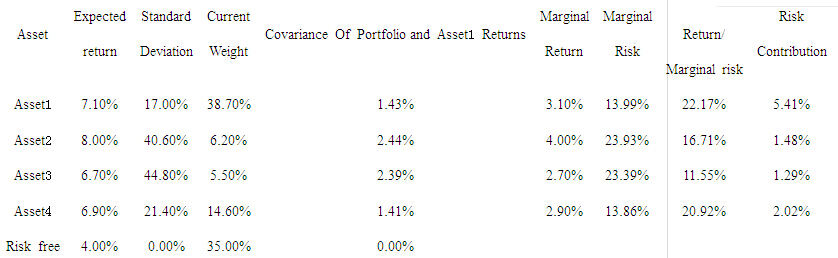

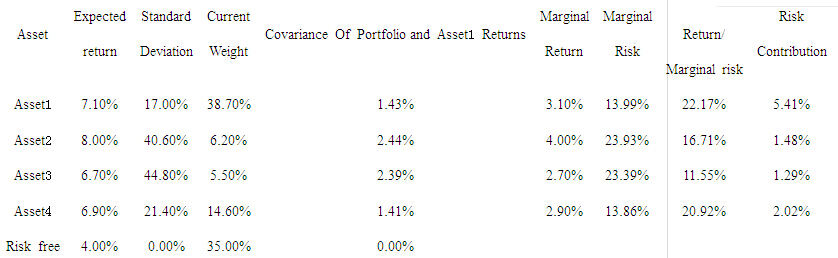

33.You are given the following information about a portfolio and are asked to make a

recommendation about how to reallocate the portfolio to improve the risk/return tradeoff.

Which of the following the recommendations will improve the risk/return tradeoff of the portfolio?

A.Increase the allocations to assets 1 and 3 and decrease the allocations to assets 2 and4.

B.Increase the allocations to assets 1 and 2 and decrease the allocations to assets 3 and4.

C.Increase the allocations to assets 2 and 3 and decrease the allocations to assets 1 and4.

D.Increase the allocations to assets 1 and 4 and decrease the allocations to assets 2 and3.

Answer:D

A.Incorrect.Asset 3 should be decreased since it has the lowest marginal return-to-marginal risk ratio.

B.Incorrect.Asset 4 should be increased since it has the highest marginal return-to-marginal risk ratio.

C.Incorrect.Asset 4 should be increased since it has the highest marginal return-to-marginal risk ratio.

D.Correct.A portfolio optimizing the risk-reward tradeoff has the property that the ratio of the marginal return to marginal risk of each asset is equal.Therefore,this option is the only recommendation that will move the ratios in the right direction.

34.Calculate the estimated default frequency(EDF)for a KMV credit risk model using the

data given below(all figures in millions).Assets Liabilities Market value 195 185 Book

value 180 165 Standard deviation 25 15 of returns

A.11.5%.

B.27.4%.

C.34.5%.

D.57.9%.

Correct answer:A

The distance between the current value of the assets and the book value of the liabilities=195-165=30.Using the standard deviations in the return on assets this distance=30/25=1.2 standard deviations.Thus the probability of default=cumulative probability of standard normal distribution below-1.2,i.e.11.5%.

35.Suppose the payoff from a merger arbitrage operation is$5 million if successful,-$20million if not.The probability of success is 83%.The expected payoff on the operation is

A.$5 million

B.$0.75 million

C.$0 since markets are efficient

D.Symmetrically distributed

Answer:B

The expected payoff is the sum of probabilities times the payoff in each state of the world,or 83%×$5+17%×(-$20)=$4.15-$3.40=$0.75.Note that the distribution is highly asymmetric,with a small probability of a large loss.

更多资讯可关注FRM官方微信:“gaodunfrm”或加入FRM考试QQ交流群:153301485!若需引用或转载本文章请保留此处信息。

这么多FRM资料总有一款适合你:

FRM+CFA**资料免费获取:https://jinshuju.net/f/MJQYVK?x_field_1=qita_frmgdcn

>>>>新版FRM一二级内部资料扫码免费领!【精华版】

- 上一篇:金融风险管理师考试时间2017

- 下一篇:FRM一级教材NOTES资料介绍

热门搜索

猜你喜欢换一批

- FRM证书相当于金融硕士学位

- 【FRM科普】现代信用风险管理模型有哪些?

- 什么是金融风险管理师?风险管理的四个步骤是什么?

- 注册金融风险管理师是什么?FRM和CFRM区别有什么?

- frm金融英语词汇有哪些?金融英语要怎么学?

- 非金融专业可以考FRM吗?FRM潜在报名条件是什么?

- 2022年FRM需要考英语吗?如何开始学习金融英语?

- 金融专业考cfa和frm双证有帮助吗?

- 女生学金融学好就业吗?金融专业的同学适合考什么证书?

- FRM考试内容是什么?金融大一新生值得考吗?

考

试倒

计

时

试倒

计

时

距离下次FRM考试

还剩

{{GetRTime1}}

天

重要提醒

- 24年5月11日-17日是FRM一级考试时间

- 24年5月18日-22日是FRM二级考试时间

- 23年12月1日:FRM23年5月FRM考试【早鸟价报名阶段】开始

- 24年2月1日:FRM23年5月FRM考试【标准价报名阶段】开始

- 24年4月21日:FRM23年5月FRM考试【考位选择】截止

热门阅读换一换

- 12023frm百度网盘,这些资料你有吗?

- 2FRM历年通过率高吗?如何提高FRM通过率?

- 3CFA、FRM、CPA都值得考吗?

- 4高顿FRM资料全分享:2023年全新FRM备考教材分享(附视频)!

- 5大学生考哪些国际证书比较好?FRM,CFA还是acca?

- 6FRM复习资料全部汇总:了解FRM入门、复习、练习所有教材!

- 7一份在职备考FRM的复习安排!

- 8FRM考试费用一般是多少,考完两级得花多少钱!

- 9备考FRM考试,别人只要3个月,我却花了一整年!

- 10CFA和FRM都考有用吗,难度大不大?

- 112020年11月FRM报名将在10月15号截止!

- 122023年5月FRM一级备考,很实用的复习方法!

- 13【新手必看】2020年FRM考试报名费用各类细节问题汇总答疑

- 14重要通知:2021年FRM考试改革,FRM考试改为机考模式!

- 15CFA和FRM,我是不是要都考?

- 16经验分享:21岁金融系女生高分考过FRM,干货分享!

- 17报完FRM考试后能延期考试吗?如何延期?

- 18金融风险是做什么的,有必要考FRM(金融风险管理师)吗?

- 19什么是机器学习

- 20什么是风险效应

- 21债券结算代理业务是什么

- 22本票关系是什么

- 232023年frm一共几级

- 24什么是信用卡呆账核销

- 25FRM报名怎么交费

- 26企业特有风险是什么

- 27国际贸易学是什么

- 28考完frm一级是不是一定要考二级

- 29低风险扩张理论是什么

- 30什么是出口收汇风险